Working Capital Secrets in the Food & Beverage Industry

Did you know that late payments put 23% of SMEs at risk of closure? It's very shocking to also see that an average of 44.6% of the total B2B receivables remained unpaid after the due date (Siemens, 2023).

In today’s post, we will be delving into the world of financial strategy as we unveil the secrets of factoring tailored specifically for the Food & Beverage industry. In this post, we'll show the key insights and strategies to empower businesses in managing cash flow, enhancing financial stability, and navigating the landscape of factoring.

Unlocking Financial Agility with the Use of Factoring

Research has proven that to be a major player in the F&B industry you need to be agile. By using a factoring solution you are not only allowing your business to have flexibility in managing its cash flow but you’re also ensuring your operations run smoothly and ready for growth.

There are several benefits to factoring and some of them are: improved cash flow, risk mitigation, outsourced collections and many more. Factoring has become more and more popular over the years with reports suggesting that over 25,000 companies use factoring solutions with invoice factoring being one of the popular choices.

Factoring and credits have been in the industry for several years but since the pandemic, more and more wholesalers are looking into factoring, which leads us to our next point of how it actually works.

Factoring is a financial strategy that injects immediate cash flow into your business by leveraging your accounts receivable. The process is quite simple but provides loads of value to wholesalers in the F&B space. The process begins with a business selling its accounts receivable – unpaid invoices – to a third-party financial institution known as a factor. In return, the business receives an immediate infusion of cash, typically a percentage of the total invoice value. The factor then takes over the responsibility of collecting payments from the customers. Sound simple enough?

Factoring ends up being a win-win situation for wholesalers as it significantly shortens payment cycles, giving your business quicker access to funds.

Tailored Solutions for F&B:

Unfortunately with factoring, you need to find the right partner and hence we recommend researching and speaking to factoring companies to see if you’re a good match. Below are just some of the questions we recommend to ask factoring companies to ensure that you are a good match for them.

- How Long Have You Been in Business? : Experience matters in any industry, but it’s particularly crucial in factoring.

- What Is the Factoring Company’s Terms, Fees, and Funding Limits? : The nuances of financial details such as terms, funding limits, and factoring fees present the most variability when choosing a factoring company for your business. We also recommend reviewing proposals and contracts with your accountant to minimize the unexpected financial impact.

- Where Are the Factoring Company’s Funds Coming From? : The funds that the factoring company advances you are coming from somewhere; find out where. Remember, an independent factor might be borrowing funds from a third party, which can lead to feeling uneasy given a reduced sense of security, whereas a bank factor uses its own funds.

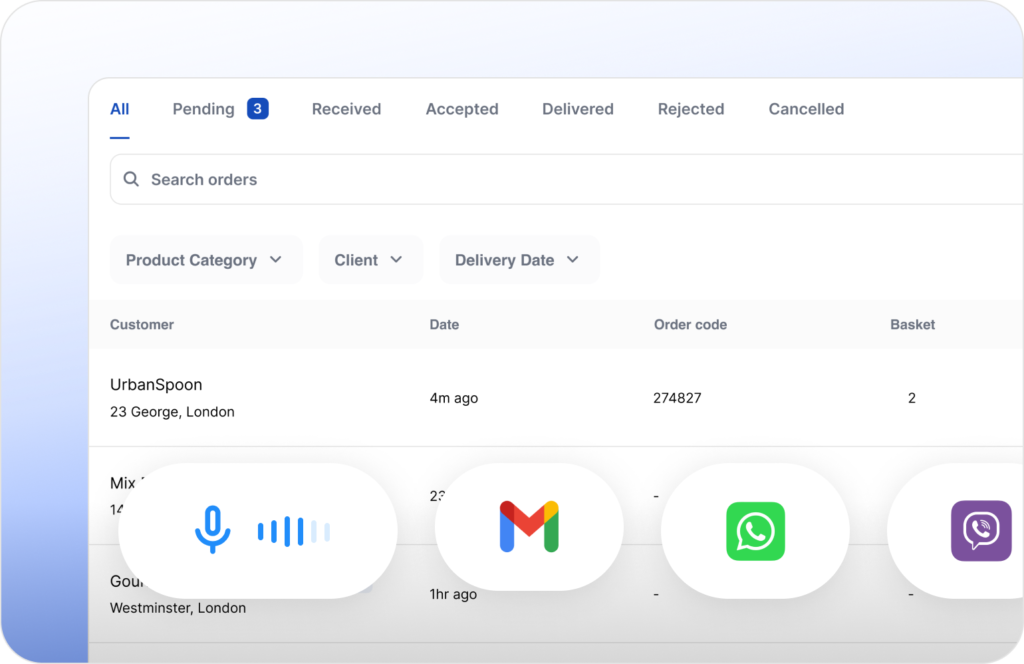

We at Orderit spoke to several executives at the top F&B wholesalers and they all said that we needed a factoring solution which is tailored to the F&B industry. Thus presenting Orderit's CashFlowPlus: A Smart Factoring Solution for B2B. CashFlowPlus is a factoring solution which revolutionises how traditional businesses manage their cash flow. Designed to provide immediate liquidity, this digital platform transforms B2B invoices into cash rapidly, mitigating the challenges of delayed payments. If you’d like a factoring solution which is tailored for wholesalers and suppliers in the F&B space reach out to us today at [email protected]. To find out more information check out our website.

Conclusion:

Factoring isn't just a tool; it's a strategic approach that empowers your F&B business to thrive, bringing financial agility, tailored solutions, and streamlined payment cycles to the forefront. In this article, we went over the need for factoring, how it works and how it benefits you. Alongside, we introduced our new service, “CashFlowPlus” which is a tailored factoring solution for the wholesalers and suppliers in the F&B industry.